Below is an introduction to the financial sector, with an analysis of some key designs and theories.

Throughout time, financial markets have been a widely investigated region of industry, resulting in many interesting facts about money. The field of behavioural finance has been important for understanding how psychology and behaviours can affect financial markets, leading to a region of economics, referred to as behavioural finance. Though the majority of people would presume that financial markets are logical and stable, research into behavioural finance has discovered the fact that there are many emotional and mental aspects which can have a powerful impact on how people are investing. As a matter of fact, it can be stated that financiers do not always make judgments based upon logic. Instead, they are often influenced by cognitive predispositions and emotional reactions. This has led to the establishment of theories such as loss aversion or herd behaviour, which can be applied to buying stock or selling investments, for instance. Vladimir Stolyarenko would recognise the complexity of the financial industry. Likewise, Sendhil Mullainathan would praise the energies towards researching these behaviours.

When it concerns understanding today's financial systems, among the most fun facts about finance is the use of biology and animal behaviours to motivate a new set of designs. Research into behaviours associated with finance has influenced many new methods for modelling elaborate financial systems. For instance, studies into ants and bees show a set of behaviours, which run within decentralised, self-organising colonies, and use quick rules and regional interactions to make collective choices. This principle mirrors the decentralised characteristic of markets. In finance, scientists and analysts have had the ability to apply these principles to understand how traders and algorithms communicate to produce patterns, like market trends or crashes. Uri Gneezy would concur that this intersection of biology and economics is an enjoyable finance fact and also shows how the disorder of the financial world might follow patterns spotted in nature.

An advantage of digitalisation and innovation in . finance is the ability to analyse large volumes of information in ways that are certainly not feasible for humans alone. One transformative and extremely valuable use of innovation is algorithmic trading, which describes an approach involving the automated exchange of monetary assets, using computer programmes. With the help of complex mathematical models, and automated instructions, these algorithms can make instant choices based on actual time market data. As a matter of fact, among the most intriguing finance related facts in the present day, is that the majority of trade activity on stock markets are carried out using algorithms, rather than human traders. A prominent example of an algorithm that is widely used today is high-frequency trading, where computers will make thousands of trades each second, to capitalize on even the smallest cost changes in a far more effective manner.

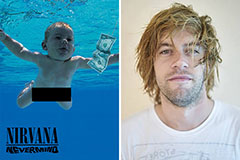

Spencer Elden Then & Now!

Spencer Elden Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!